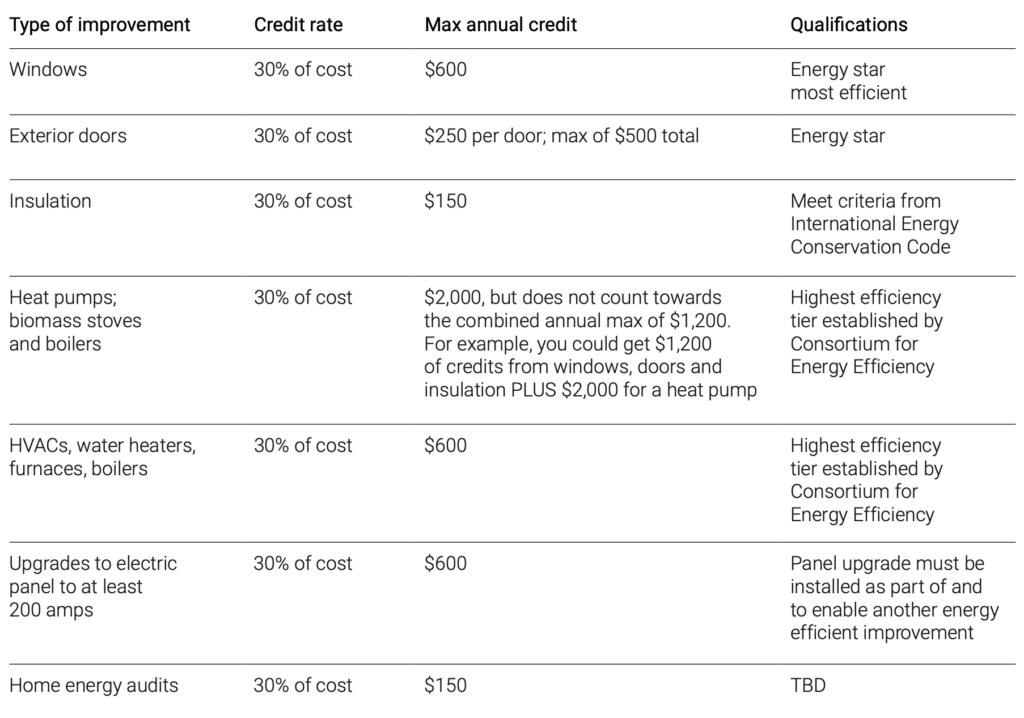

Home Improvement Deductions 2024 – Interest that is payable on loans taken for home improvement are tax deductible up to Rs.30,000 per annum. There are some simple steps that are needed to apply for a home improvement loan and to get . The Internal Revenue Service (IRS) has just released the updated income tax brackets for 2024, enabling individuals .

Home Improvement Deductions 2024

Source : www.nerdwallet.com

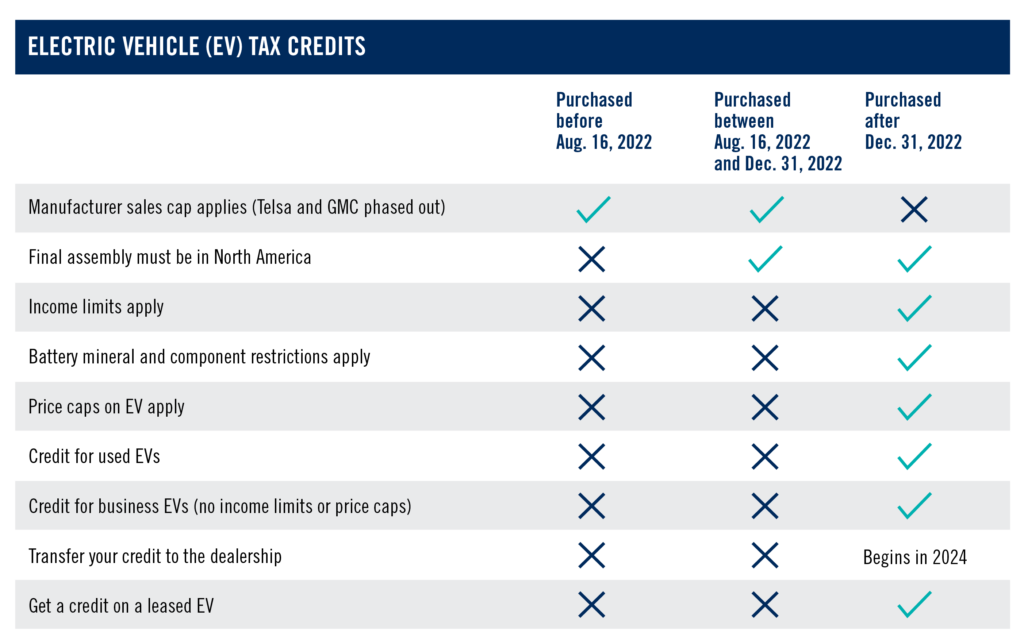

dcbel on LinkedIn: Many people qualify for green energy benefits

Source : www.linkedin.com

IRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.com

Green Home Improvements? Get Tax Credits with Inflation Reduction

Source : smithpatrickcpa.com

20 Popular Tax Deductions and Tax Credits for 2023 2024 NerdWallet

Source : www.nerdwallet.com

2024 Medicare Part B Premiums and Deductibles Increase Slightly

Source : www.allzonems.com

Child Tax Credit 2023 2024: Requirements, How to Claim

Source : www.nerdwallet.com

Claim Inflation Reduction Act Credits on Your Tax Return

Source : www.cainwatters.com

First time home buyer tax credit: What to know in 2024

Source : finance.yahoo.com

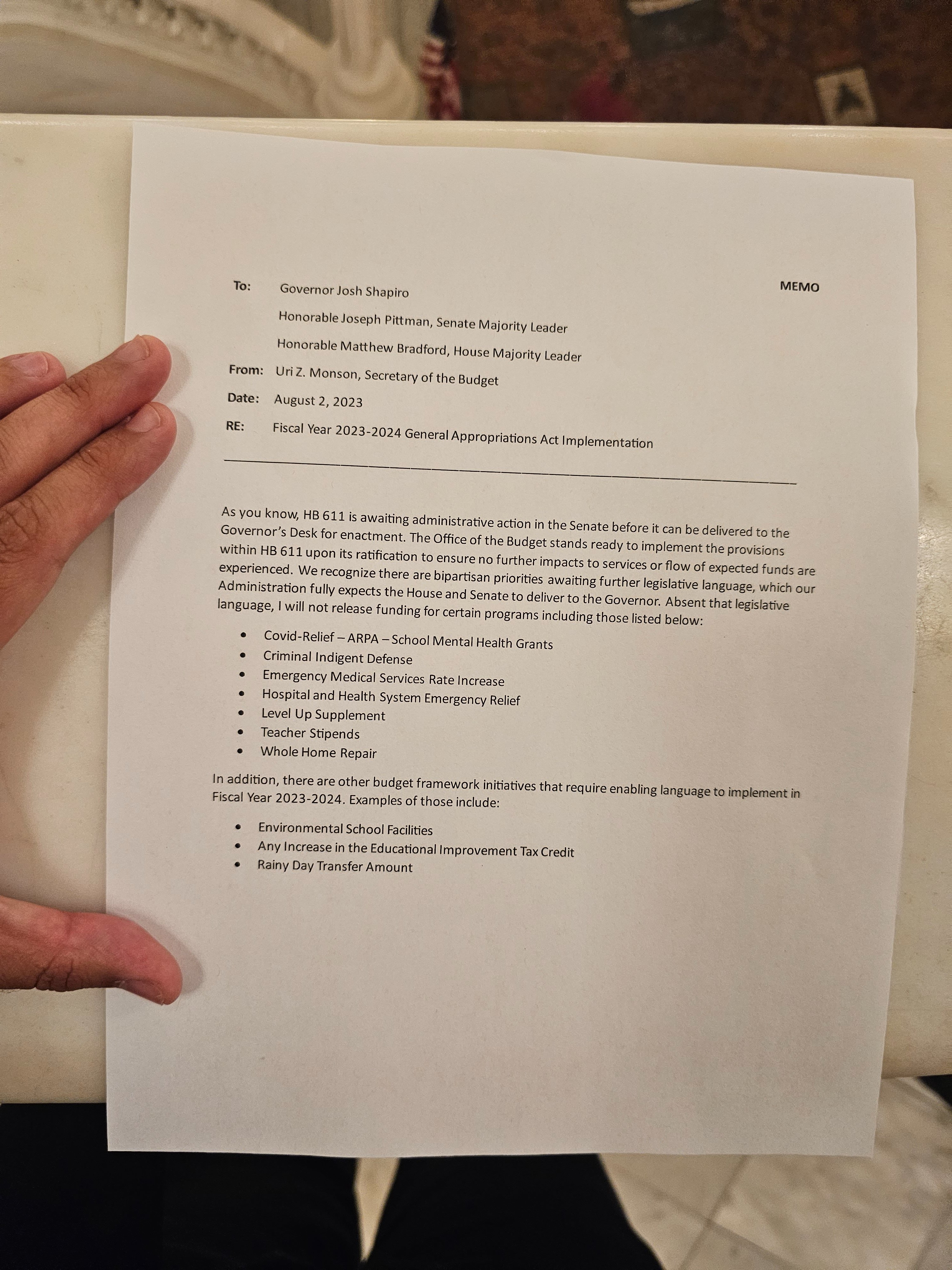

Stephen Caruso on X: “Here is the memo Pittman referenced. Level

Source : twitter.com

Home Improvement Deductions 2024 20 Popular Tax Deductions and Tax Credits for 2023 2024 NerdWallet: Note: If the medical home improvement raises the value of your home, the deduction will be based on the difference between the cost of the improvement and the increase in property value. . The 2023 standard deduction is $13,850 for single filers, $27,700 for joint filers or $20,800 for heads of household. People 65 or older may be eligible for a higher standard deduction amount. .